“`html

In an exciting turn of events for cryptocurrency enthusiasts, Bitcoin (BTC) has shown remarkable stability, hovering around $118,300. This figure marks a 6.6% increase for the week, bolstered by June’s U.S. Consumer Price Index (CPI) report, which has calmed investor fears. Meanwhile, ether (ETH) has emerged as a focal point for traders, as it gears up for a potential breakout to all-time highs.

Bitcoin’s Current Performance

As Bitcoin settled near $118,400, it recorded a modest daily gain of 0.4% and a weekly increase of 6.5%. This performance is indicative of a broader trend in the cryptocurrency market that is being fueled by ETF-driven inflows. Investors are closely watching Bitcoin, particularly as its price approaches the critical resistance level of $120,000.

Ether’s Impressive Surge

Ether has been a standout performer, climbing 6.7% in the past 24 hours and an impressive 20.5% over the week, currently holding above $3,340. With many traders eyeing record highs, the excitement surrounding ETH is palpable. For those looking to invest in Ethereum, you can learn more about how to buy Ethereum and capitalize on its potential.

Other Major Cryptocurrencies on the Move

XRP (XRP) continues its upward trajectory, gaining 6.4% in a single day to reach $3.09, representing a staggering 27% increase over the week. This positive momentum has been attracting attention, especially as XRP remains a hot topic in the cryptocurrency community. For more insights into XRP, check out our detailed overview and price predictions.

Solana’s SOL (SOL) also saw gains, increasing by 5% to $170, while dogecoin (DOGE) added 6% to trade just above 20 cents. Additionally, BNB Coin (BNB) experienced a rise of nearly 3% to $708, and Tron’s TRX (TRX) increased by 3.7% to 31 cents. These gains reflect a broader, risk-on sentiment in the crypto market.

Market Sentiment and ETF Optimism

The overall market remains optimistic, with top cryptocurrencies extending their gains for the second consecutive day amid continued ETF enthusiasm and favorable macroeconomic conditions. Notably, U.S. spot bitcoin ETFs recorded their tenth consecutive day of net inflows, totaling $799 million on Wednesday, driven primarily by BlackRock’s IBIT with a whopping $763 million.

Macroeconomic Factors Influencing Cryptocurrency

The macroeconomic landscape is playing a crucial role in shaping the cryptocurrency market. Asian equities experienced a slight dip as investors reassessed the timing of rate cuts, while gold prices edged higher. Concurrently, the dollar softened, providing substantial support for dollar-denominated crypto assets. The dollar index (DXY) is down approximately 10% year-to-date, further enhancing the appeal of cryptocurrencies as alternative investments.

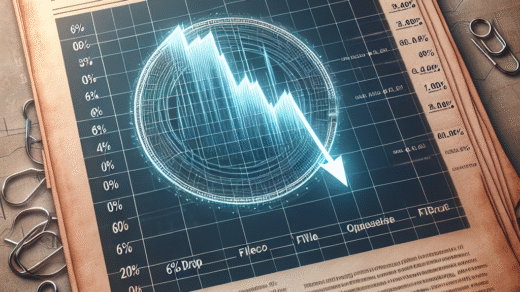

Profit-Taking vs. New Demand

Amid this complex interplay between profit-taking and new demand, analysts remain divided on the future trajectory of Bitcoin. Traders at QCP pointed out that Bitcoin’s momentum faced a temporary stall after surpassing $120,000, leading to a developing support zone between $114,000 and $118,000. Despite this, downside bids have begun to re-emerge, highlighting the cautious sentiment among some investors.

Optimistic Predictions for Bitcoin’s Future

Despite the potential for seasonal trading slowdowns and equity exhaustion, bullish sentiments persist. Ryan Lee, chief analyst at Bitget Research, expressed optimism in a note to CoinDesk. He stated, “The road to $150,000 by Q3 looks increasingly plausible, powered by ETF inflows, supply constraints, and macro tailwinds like a weakening dollar and potential Fed cuts.”

How to Navigate the Current Crypto Landscape

For those looking to navigate the current cryptocurrency landscape, it’s crucial to stay informed about market trends and potential investment opportunities. Whether you’re interested in buying Bitcoin, Ethereum, or exploring other altcoins, understanding the dynamics of the market can significantly enhance your investment strategy. To learn how to purchase various cryptocurrencies, visit our guides on buying Bitcoin, buying cryptocurrency, and buying Solana.

Conclusion

In conclusion, the current state of the cryptocurrency market is characterized by a mix of optimism and caution. With Bitcoin’s steady performance and ether’s impressive gains, traders are eagerly watching for potential breakouts. As the macroeconomic landscape continues to evolve, the interplay between profit-taking and new demand will shape the future trajectory of these digital assets. Stay tuned for more updates as we monitor these developments.

“`

Meta Description: “Discover the latest cryptocurrency trends as Ether surges 8% while Bitcoin steadies at $118K. Learn about profit-taking in BNB, SOL, and DOGE amidst ETF optimism and macroeconomic influences. Stay informed on Bitcoin’s potential breakout to $150K!”