Introduction to ProShares’ Ultra CRCL ETF

ProShares, a leading provider of exchange-traded funds (ETFs), has recently launched an innovative product known as the Ultra CRCL ETF (CRCA). This new ETF is designed to double the daily performance of Circle’s stock (CRCL), providing traders with a unique opportunity to make leveraged bets on one of the most influential companies in the cryptocurrency finance sector.

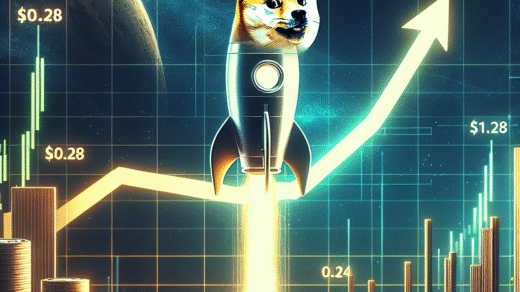

Circle’s Remarkable Journey and Performance

Circle, widely recognized as the issuer of the USDC stablecoin, has made headlines following its public debut on the New York Stock Exchange (NYSE). Since its IPO, Circle’s shares have surged an impressive 134%. This increase can be attributed to several factors, including the growing adoption of the USDC stablecoin and recent legislative support aimed at facilitating digital payments.

The Role of USDC Stablecoin in Circle’s Growth

As a major player in the stablecoin market, Circle’s USDC has garnered significant attention due to its robust backing and increasing utility within the digital finance ecosystem. The stablecoin serves as a bridge for traditional finance and cryptocurrency, making it an attractive option for investors and businesses alike. Furthermore, Circle’s commitment to supporting tokenized assets, blockchain development tools, and an extensive payment network connecting over 185 countries enhances its reputation as a leader in the crypto finance landscape.

Regulatory Framework: A Turning Point for Stablecoins

The introduction of the Ultra CRCL ETF comes at a pivotal moment when U.S. regulators are beginning to establish formal rules surrounding stablecoins. The recent passage of the GENIUS Act in mid-July has created a legal framework for payment stablecoins, providing much-needed clarity on how companies like Circle can operate within the U.S. financial system. However, it’s important to note that federal banking regulators are still in the process of drafting formal rules that will govern the sector.

Leveraged ETFs: What Traders Need to Know

For traders who anticipate that Circle will thrive under this new regulatory clarity, the Ultra CRCL ETF offers a compelling way to amplify their exposure to Circle’s stock without the need for direct borrowing. Leveraged ETFs like CRCA are specifically designed for short-term trading rather than long-term investments. It’s crucial for traders to be aware that these funds are rebalanced daily, which may lead to performance divergence from expectations if held over extended periods.

ProShares and Its Expanding ETF Catalog

ProShares boasts a diverse catalog of over 150 ETFs, including popular funds like the UltraPro QQQ and the bitcoin-linked BITO. In recent years, the firm has increasingly focused on digital assets, introducing funds tied to major cryptocurrencies such as ether, solana, and XRP. This strategic pivot underscores ProShares’ commitment to staying at the forefront of the evolving financial landscape.

Circle’s IPO and Its Growing Investor Interest

Although Circle’s IPO initially attracted limited mainstream attention, its remarkable stock performance has since captured the interest of investors. The growing recognition of Circle as a significant player in the future of regulated crypto payments is reflected in its stock price trajectory. As digital dollars gain traction, companies like Circle are positioned to play an essential role in this transformation.

Conclusion: The Future of Circle and CRCA ETF

In summary, the launch of the ProShares Ultra CRCL ETF represents an exciting development for traders looking to leverage their exposure to Circle’s stock. As the regulatory landscape for stablecoins evolves and the adoption of digital currencies expands, Circle stands to benefit significantly. The CRCA ETF offers investors a unique opportunity to capitalize on this potential growth, but it is essential to approach leveraged trading with caution and a thorough understanding of the risks involved.

Further Resources

If you’re interested in exploring more about the world of cryptocurrency and how to invest, consider checking out our guides on How to Buy Bitcoin, How to Buy Cryptocurrency, and How to Buy Ethereum. For insights on trading platforms, you can also read our reviews of Kraken, Binance, eToro, and KuCoin.

Meta Description: Discover how ProShares’ new Ultra CRCL ETF allows traders to leverage Circle stock performance, explore the implications of growing regulatory clarity, and learn about the future of cryptocurrency investments.