The cryptocurrency market is experiencing renewed volatility as Solana (SOL) has plunged by 5%, dropping below its previously stable trading range of $177. This decline is indicative of broader concerns regarding global economic stability, prompting many investors to reevaluate their risk exposure in digital assets. In this article, we will explore the factors contributing to Solana’s price drop, technical analysis of its recent performance, and the implications for institutional investors.

Understanding the Current Market Conditions

The recent sell-off in Solana comes amid increasing geopolitical tensions that have unsettled financial markets worldwide. Investors are becoming increasingly cautious, leading to a reassessment of their positions in cryptocurrencies. Despite this pullback, it is worth noting that Solana’s ecosystem is expanding, with R3’s strategic pivot to integrate with its blockchain. This move signals a growing institutional interest in Solana’s capabilities for tokenizing real-world assets.

Technical Analysis of Solana’s Recent Performance

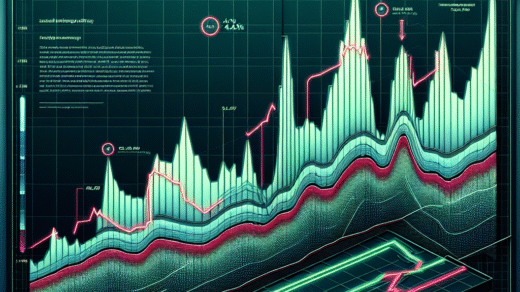

As of the latest data, Solana’s price has dropped from its stable $177 range to find support at approximately $170.41, representing a correction of 4.5%. During the midnight hour, a dramatic volume spike to 1.26 million units was recorded when prices fell below the $172 mark. Support levels have been established between $170.67 and $171.66, which have held thus far.

In the last hour of trading, Solana’s price made an attempt to recover towards the $174 level but faced resistance. Notably, SOL declined from $172.93 to $172.00. A significant price drop occurred at 08:00, where the price briefly touched $171.92 before making a recovery. During this minute, the volume spiked to 29,372 units, indicating substantial institutional selling pressure.

Current Support and Resistance Levels

Temporary support was found within the $171.80 to $171.85 range around 07:30-07:31. A local high of $172.35 was reached at 07:36 during a recovery attempt. Currently, the price continues to consolidate near the $172 support level. Investors should keep a close eye on these levels, as any breach could signal further declines or potential rebounds in the price of Solana.

Institutional Interest in Solana’s Ecosystem

Despite the recent price drop, Solana’s ecosystem shows promising signs of growth. R3’s decision to integrate its blockchain for tokenizing real-world assets reflects an increasing institutional interest. This trend may provide a level of support for SOL in the longer term, as more entities explore the potential of blockchain technology.

Future Price Predictions for Solana

Analysts are closely monitoring Solana’s performance to determine its next potential move. Some projections indicate that SOL could break the $180 resistance in the near future. For detailed insights, check out our article on XRP Price Predictions and other cryptocurrencies. As the market evolves, it will be crucial for investors to remain informed about the factors influencing Solana’s price.

Conclusion: What Investors Should Watch For

In summary, the recent 5% drop in Solana’s price is a reflection of broader economic concerns and increased selling pressure from institutional investors. However, the continued expansion of Solana’s ecosystem, along with the establishment of key support levels, presents a mixed outlook for SOL. Investors should stay vigilant, monitor market conditions, and be prepared for potential volatility in the coming days.

For those looking to invest in Solana, understanding how to buy SOL is essential. Check out our comprehensive guide on How to Buy Solana to get started. Additionally, for a broader perspective on the cryptocurrency market, consider exploring our articles on Bitcoin ETFs, Ethereum, and other prominent cryptocurrencies.

Meta Description:

Stay informed about Solana’s recent 5% drop amid mounting institutional selling pressure. Explore the implications for investors, technical analysis, and future price predictions in our latest article on cryptocurrency market trends.