Ethereum’s Price Movement: A Closer Look at the $4,000 Target

Ethereum (ETH) has been on an impressive multi-week ascent, approaching the critical $4,000 mark. However, the latest trading session has seen a dip, with ETH falling over 3% to approximately $3,696. This fluctuation raises questions about the sustainability of its upward trend, especially in light of recent whale purchases and the looming threat of a market correction.

Current Market Situation: Bulls vs. Bears

Despite the recent pullback, many bulls remain optimistic about Ethereum’s potential to maintain its uptrend. Yet, the price action has revealed some technical vulnerabilities. Analysts are now debating whether ETH can continue to climb without experiencing a broader market correction. Technical indicators, such as the Relative Strength Index (RSI), are beginning to show signs of overheating, suggesting that the current bullish sentiment may be unsustainable without a consolidation period.

Whale Activity: A Double-Edged Sword

Interestingly, whale buying activity has surged to record highs, with institutional investors ramping up their accumulation of ETH. One notable development comes from SharpLink Gaming (SBET), a significant player in the ETH market. In a recent press release, the company disclosed that it purchased 79,949 ETH in the week ending July 20, marking the highest weekly accumulation since implementing its treasury strategy in June. Currently, SharpLink holds an impressive 360,807 ETH and has over $96 million in undeployed capital ready for additional investments.

Technical Analysis: Understanding the Risks

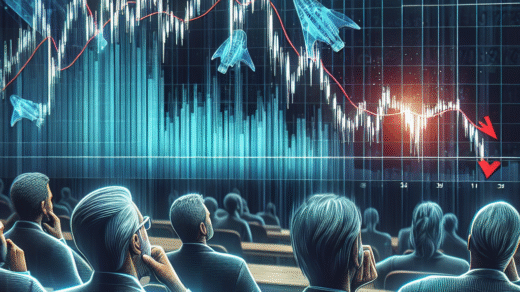

On July 22, Ethereum experienced a 6.11% drop within a 24-hour period, falling from a session high of $3,851.59 to a low of $3,623.60. This significant fluctuation indicates a bearish momentum that intensified early in the trading day. As ETH plunged from $3,731.37 to $3,656.39, trading volume surged to 353,275 units, significantly above the 24-hour average of 265,473.

Resistance levels have formed around the $3,730–$3,740 zone, and the brief recovery that lifted ETH to $3,698.04 was short-lived due to renewed selling pressure. By the end of the trading session, ETH closed near its intraday low at $3,647.45, indicating a continued risk of downside movement as we head into the next trading cycle.

Key Support Levels and Market Sentiment

As the trading session progressed, ETH breached crucial support levels at $3,690, $3,670, and $3,650. The decline accelerated significantly between 13:30 and 13:55 UTC, with high-volume liquidations exceeding 20,000 units per minute. This rapid sell-off further solidified the bearish sentiment that has taken hold in the market.

Analysts like Michaël van de Poppe and Andrew Crypto have raised concerns about the potential for a “violent correction.” While Andrew Crypto acknowledges ETH’s recent strength, he emphasizes that a correction is not only healthy but also likely following a rejection at a significant resistance level.

Long-Term Outlook: Can ETH Break Through $4,000?

Despite the current volatility, some analysts maintain a bullish perspective. Crypto Rand, for instance, predicted on July 8 that “ETH to $4,000 is programmed. Sooner than later.” This sentiment is supported by on-chain metrics, which show that whale activity has been a driving force behind Ethereum’s price resilience amidst macroeconomic uncertainties.

Retail and institutional investor confidence in Ethereum continues to grow, reflecting a strong belief in the cryptocurrency’s long-term potential. Yet, as Andrew Crypto aptly notes, “A chart without a correction isn’t a healthy chart.” This suggests that for Ethereum to achieve sustained growth, a period of consolidation may be necessary.

Conclusion: What Lies Ahead for Ethereum?

As Ethereum trades at around $3,696, down 3.44% in the past 24 hours, investors must remain vigilant about market dynamics. The interplay between whale purchases and potential corrections will likely shape ETH’s trajectory in the coming weeks. While the bullish outlook remains, it’s crucial to acknowledge the risks that lie ahead, especially as technical indicators signal a need for caution.

In summary, Ethereum’s journey toward the $4,000 milestone is fraught with challenges, but the underlying fundamentals, including robust whale activity and institutional interest, offer a glimmer of hope for long-term growth. Stay informed by following the latest developments in the cryptocurrency market.

Meta Description: Discover the latest insights on Ethereum’s price movements as it approaches $4,000. Analysts weigh whale purchases against potential correction risks, offering a comprehensive analysis of market dynamics. Stay updated with expert commentary and technical analysis.